Following is a letter published in the Financial Times:

Dear Sir,

The UK regulators on this issue are exactly right in the way they are handling the Northern Rock situation, as are its depositors, who have lost confidence in the bank, that is, in the bank’s management ("Scramble to quit UK mortgage lender" September 14, 2007).

Indeed, the Bank of England has been the only leading central bank that has not failed in the current turbulent times. The others have acted too soon, too much and continued to transmit the very lack of confidence that they have been trying to quell.

If Northern Rock is basically solvent, the regulators are there to provide the emergency liquidity required, at a significant penalty cost, of course.

The highly-paid senior managers at Northern Rock have shown high growth and profits in recent years and have been heroes, and been well paid for it, while the markets were good. When times are tough, they have been shown to have been irresponsible, going for growth and results, but at the expense of maintaining that most prized requirement for a bank, the confidence of the markets and of its customers.

This confidence is always going to be tested when times are tough, when everything is good, no one notices. Good bank managements need to manage on that fine line of maximizing performance, while at the same time ensuring that their institution maintains its position when a downturn comes...........and a downturn always comes. Not that long ago, Barclays had a couple of missteps with hardly a peep of concern from its depositors. They have obviously done something right.

Northern Rock’s managers have got themselves into the ridiculous situation where they had a large share buyback programme in place, all good but, when the share price goes down more than 30%, they have to cancel it! They couldn’t be seen to be buying their shares too cheaply, I suppose.

The music has stopped and senior managers at Northern Rock have found themselves without a seat. Whether Northern Rock survives this process or not, its senior managers need to go!

Onésimo Alvarez-Moro

See article:

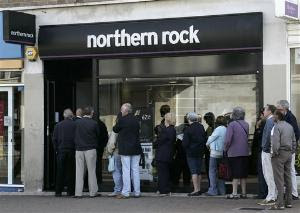

The turmoil in global banking hit the streets of Britain on Friday as thousands of Northern Rock customers queued up to withdraw their savings from the UK mortgage lender after it was rescued by the Bank of England.

As regulators and politicians called for calm, Northern Rock – Britain’s fifth-biggest mortgage lender – scrambled to contain the fallout after it became the first British bank in decades to be bailed out by regulators. One person close to the situation said customers had withdrawn about $2bn Friday but Northern Rock declined to comment on the figure, which would amount to 4 per cent of its deposit base.

The rescue demonstrates the risks from a decade of financial innovation in the capital markets, which allowed a small regional lender to wield financial clout far greater than its network of 76 branches would suggest.

See full Article (paid subscription required).